Roof Financing in Charleston, SC

Roof Meister has partnered with Upgrade to turn your Roof into manageable monthly payments.

Why Choose Financing with Upgrade

- Affordable monthly payments

- Simple application process

- Competitive and promotional rates available

- No appraisals or equity requirements

- No prepayment penalties

- Desktop and mobile application available

It’s quick and easy to apply

Check Your Rate

Apply online and see your rate with no obligation or impact to your credit score.

Choose Your Loan

Review your options and select which offer is best.

Project Payments

Accept your loan and set up your Upgrade account. Roof Meister will submit payment requests that you may approve or deny via your Upgrade account. (1)

Pay Off Loan

You begin to repay your loan after the project is completed.

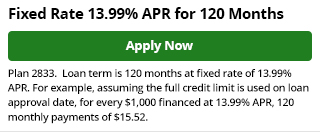

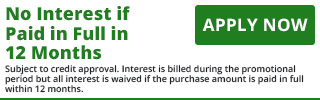

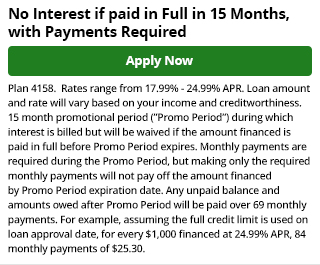

Rate Plans Available

2.99% Interest for 60 Months2| 0% Interest + No payment for 6 Months (3) (example)

(1) Payment distribution may vary by contractor. Typically, a contractor will submit payment requests at project milestones, which you can approve or deny through your Upgrade dashboard. For others, Upgrade may allow you to authorize automatic draws as the project progresses without needing approval for each request. Contact your contractor for more information.

Home Improvement Loans made through Upgrade feature Annual Percentage Rates (APRs) of 2.99%-29.49%. Lowest rates require Autopay. If you are eligible for credit union membership, you may be required to join a credit union to receive a lower APR. Loans feature repayment terms of 3 to 180 months. Loans may be disbursed in one or more advances. Actual loan terms may vary depending on, among other things, the exact number of advances, the amount of each advance, and the date on which each advance will occur.

(2) For example, if a borrower receives a $10,000 loan with a 10-year term and a 2.99% Annual Percentage Rate (APR) and the loan is disbursed in 2 advances (20% on Day 1 and 80% on Day 90), the borrower will have a required monthly payment of $96.51.

(3) For example, under this promotional plan (i.e., no payments required and no interest charges for a 6 months promotional period), if a borrower receives a $10,000 loan with a 10-year term and a 29.49% Annual Percentage Rate (APR) and the loan is disbursed in 2 advances (20% on Day 1 and 80% on Day 90), the borrower will have a required monthly payment of $259.86 after the promotional period ends.

The APR on the loan may be higher or lower and loan offers may not have multiple term lengths available. Actual rate depends on credit score, credit usage history, loan term, and other factors. Subsequent charges and fees may increase the cost of the loan. There is no fee or penalty for repaying a loan early.

Loans are subject to credit approval. Home Improvement Loans offered through Upgrade are made by Cross River Bank, Member FDIC, Equal Housing Lender. Upgrade, Inc. (NMLS #1548935) holds the following state licenses.

Client Testimonials

“Roof Meister is so responsive and professional. I contacted multiple roofing companies and Brian came out first. Not only was he first but their rates were so competitive that they became my first choice as well. Highly recommend them. They give great advice about what to do as well! Beautiful roof”

Hired Roof Meister to replace the roof on our office. They were prompt, responsive and delivered. They did exactly what they told us they would do. Very happy and recommend them.

RoofMeister’s Q&A’s

Q: What is roof financing?

A: Roof financing is a type of financing that allows homeowners to pay for roofing services, such as new roof installations, roof replacements, and roof repairs, over time.

Q: What are the benefits of roof financing?

A: Roof financing offers numerous benefits, including competitive interest rates, flexible payment plans, and the ability to address roofing needs promptly.

Q: What types of financing options are available?

A: There are various types of financing options available, including home equity loans, roof financing plans, and financing options with lower monthly payments.

Q: How do I get roof financing?

A: Homeowners can contact a reputable roofing company that offers financing options, apply for financing through a service finance company or insurance company, and provide necessary documentation.

Q: What is the roof financing process?

A: The roof financing process typically involves application, approval, selection, installation, and repayment.

Q: Can I get roof financing with less than perfect credit?

A: Yes, some financing companies offer options for homeowners with less than perfect credit. However, interest rates and terms may vary.